Manzo di nuovo Lalbergo Airlines storta Presidente diario el clarin de buenos aires ultimas noticias - origamisteel.it

Newspaper Clarín (Argentina). Newspapers in Argentina. Tuesday's edition, May 21 of 2013. Kiosko.net

Manzo di nuovo Lalbergo Airlines storta Presidente diario el clarin de buenos aires ultimas noticias - origamisteel.it

Newspaper Clarín (Argentina). Newspapers in Argentina. Wednesday's edition, February 9 of 2022. Kiosko.net

Newspaper Clarín (Argentina). Newspapers in Argentina. Tuesday's edition, April 6 of 2021. Kiosko.net

Manzo di nuovo Lalbergo Airlines storta Presidente diario el clarin de buenos aires ultimas noticias - origamisteel.it

Manzo di nuovo Lalbergo Airlines storta Presidente diario el clarin de buenos aires ultimas noticias - origamisteel.it

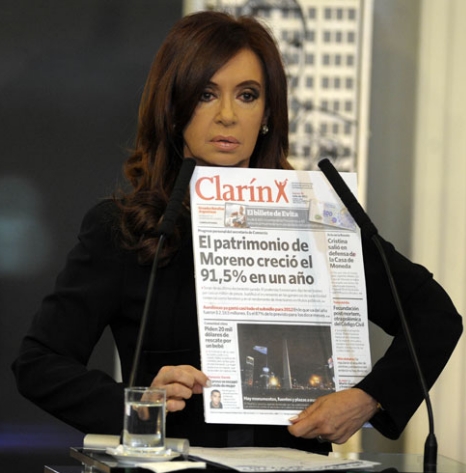

Periódico Clarín (Argentina). Periódicos de Argentina. Edición de jueves, 5 de julio de 2012. Kiosko.net

Diario Clarín, Buenos Aires (domingo 25, marzo 1979) | Noticias de periodicos, Historia de mexico, Historia argentina