Vichy DERCOS NEOGENIC anti-hair loss shampoo Replumping 200ml - Hair loss - Hair - Cosmetics and beauty | Mifarma

Vichy Dercos Neogenic Hair Renewal Treatment - Price in India, Buy Vichy Dercos Neogenic Hair Renewal Treatment Online In India, Reviews, Ratings & Features | Flipkart.com

Dercos Neogenic - trattamento rinnovamento capillare di Vichy, Siero Unisex - Fiale 28 x 6 ml : Amazon.it: Bellezza

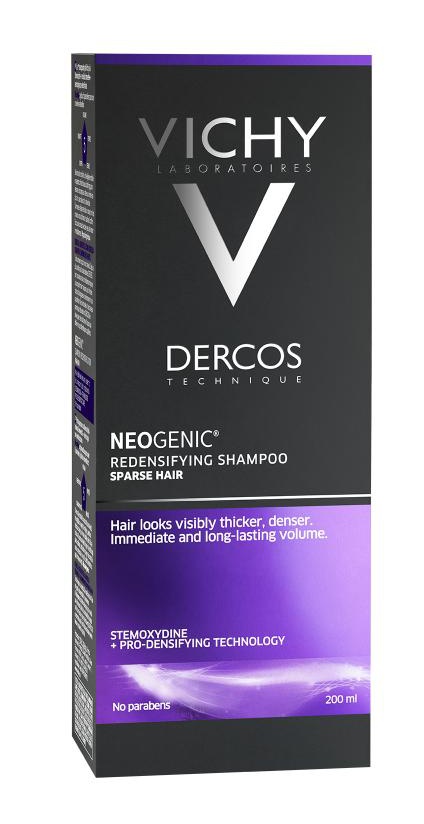

Vichy Dercos Neogenic Redensifying Shampoo - Strengthening Hair-Thickening Stemoxydine Shampoo | Makeup.uk

Vichy Dercos Neogenic è il nuovo trattamento di rinnovamento capillare alla Stemoxydina, che stimola le cellule stamin… | Electronic products, Electronics, Security

![GRELLONI DR. GRAZIANO - DERCOS NEOGENIC Trattamento di rinnovamento capillare [ ALLA STEMOXYDINE 5% - molecola brevettata ] GRELLONI DR. GRAZIANO - DERCOS NEOGENIC Trattamento di rinnovamento capillare [ ALLA STEMOXYDINE 5% - molecola brevettata ]](http://www.farmaciagrelloni.it/wsite/FCESC0002635/images/eventbox2.jpg)